Patrick.net poses the Question: As house prices continue their inexorable decline, who loses and who wins?

Thursday, January 31, 2008

HousingFEAR thought of the Day.

Posted by

Chris

at

9:23 AM

0

comments

![]()

Wednesday, January 30, 2008

Helicopter Ben to the Rescue

NEW YORK (CNNMoney.com) -- Faced with growing risks of recession, the Federal Reserve made its second deep interest-rate cut in a week and slashed a key short-term rate by a half-percentage point Wednesday.

U.S. stocks, which had been slightly lower ahead of the announcement, surged on news of the rate cut but ended lower after a volatile final two hours of trading.

The federal funds rate - an overnight bank lending rate that affects how much interest consumers pay on credit cards, home equity lines of credit and auto loans - was cut to 3.0% from 3.5%. The rate had stood at 5.25% only four months ago.

The discount rate, which is what banks pay to borrow directly from the Fed, was also cut by a half-point to 3.5% on Wednesday. The cut was made at the request of nine of the nation's 12 Federal Reserve district bank presidents.

The Fed slashed both rates by three-quarters of a percentage point in an emergency move on Jan. 22.

Source

I really believe that if most Americans were just a little bit smarter there would be a revolution tomorrow. I guess the fed will just drop the rate to 0% and create more mal-investment and let the cycle continue. America is being destroyed from within just like Rome.

Posted by

Chris

at

1:38 PM

0

comments

![]()

Real Estate Blogger sued by Developer

This story will shock and disturb you.

A Miami Realtor, and blogging friend of mine, Lucas Lechuga is being sued by Opera tower developer Tibor Hollo for 25 million dollars. He was also fired from his job as a Realtor at EWM, which is also being sued, for his blogging comments.

What is the country coming to where you lose your job, and get sued for 25 million for giving your opinion that a condo is a bad investment and a bad buying opportunity.

Are we still living in America or is this some new kind of bizzaro world?

Please visit lucas's blog Miami Condo Investments and show him your support.

Posted by

Chris

at

6:03 AM

0

comments

![]()

Tuesday, January 29, 2008

What Median Home Prices would look like if the Bubble Never Happened

.gif)

How much should you be paying for a home? The answer is easy to calculate if you understand the connection between median home prices and median incomes.

Historically, median home prices and median incomes have always shared a close relationship. From the mid-1970s to 2001, the historical ratio of median housing value vs. median household income was consistently between 2.6 and 3.0.

What this essentially means is that median home prices were (on average) 2.8x the median household income for the last 30 years. Using this 2.8 formula, it is very easy to estimate what median home prices would be if the most recent bubble never happened.

U.S. Median Home Prices

| Current Median* | What the Median Should Be | % Difference |

|---|---|---|

| $208,400 | $134,692 | 35% |

Median household income information is not yet available for 2007, so we will be using median household income data for 2006 in this example and in the following examples. It should make very little difference since household incomes increased by 4 percent at the most (and that's a very generous estimate) in 2007.

The median U.S. household income is $48,201, according to the U.S. Census Bureau. When we multiply that number by 2.8, we get $134,692. That's what the U.S. median home price should be right now. The actual median home price is about 35 percent higher that that.

Median Home Prices by Region

| Region | Current Median* | What the Median Should Be | % Difference |

|---|---|---|---|

| Northeast | $258,600 | $145,760 | 44% |

| Midwest | $159,800 | $133,941 | 16% |

| South | $173,400 | $122,875 | 29% |

| West | $309,800 | $146,297 | 53% |

It is obvious to most people that we are in the midst of a national housing bubble. Nevertheless, there are still plenty of naysayers who are telling anyone who will listen that there are local bubbles only.

Using the 2.8 formula, it is clear that local bubbles aren't the problem. Median home prices are inflated in every U.S. region. In the West, where the median household income is $52,249, median home prices are more than double what they should be. The situation is similar in the Northeast, where the median household income is $52,057.

Median home prices are not quite as high in the South and the Midwest, where median household incomes are $43,884 and $47,836 respectively. Even so, prices are still 30 percent higher than what they should be in the South and 16 percent higher than what they should be in the Midwest.

California Median Home Prices

| Current Median* | What the Median Should Be | % Difference |

|---|---|---|

| $402,000 | $158,606 | 61% |

There is no doubt about it. California was hit hardest by the housing bubble. Although prices have always been slightly elevated in the state, they grew by leaps and bounds during the housing boom.

The result is that home prices are 61 percent higher than they should be given California's media household income of $56,645. In some areas of the state, such as San Francisco and Oakland, median home prices are so inflated that they are more than 11 times the median household income.

Will Home Prices Fall?

Absolutely. Prices have already fallen by six percent nationally and by more than 11 percent in the West in a year over year comparison. Home prices must continue to fall for the average American to be able to afford a home.

The real question is: how long will it take?

The U.S. government seems to be doing everything they can to prop up prices. Before you applaud their efforts, it is worth noting that while this could work short term, all it will really do is insure we have a slow fall.

The truth is that propping up prices and prolonging the correction will not solve anything. The Japan Ministry tried to do it during the Japan correction and it was a complete disaster.

All we can really do now is prepare for the fall. It will come and it will hurt. But that's the price that must be paid for allowing the market to become artificially inflated.

*Current median refers to the median prices of existing homes in December 2007. All current median figures were taken from National Association of Realtors' EHS data.

Posted by

Chris

at

7:12 AM

2

comments

![]()

Monday, January 28, 2008

What will happen with Miami Condo Fiasco?

Its kind of like Alien vs Predator, no matter who wins, he will lose.

Zach was so stressed by the condo fiasco that he took a leave of absence from his blog in November and has not been seen since. I hope that after the closing date comes and goes 2 days from now he will update his blog and let us know what he has decided.

If you have not heard of Condo Fiasco, check out the website, linked above and read about the guy who tried to sell shares of his pre-construction condo.

Posted by

Chris

at

2:37 AM

5

comments

![]()

Saturday, January 26, 2008

Housing prices to free fall in 2008

Check out this article where Merrill Lynch predicts 15% home price drop

I read the article and If you think about it, this really makes a lot of sense.

Foreclosures are the key to driving down prices and deflating the bubble in many markets around the USA. As the number of foreclosure rises and banks begin to dump them on the market at greater and greater losses, corresponding home prices will eventually be driven back to 1999 levels as I have predicted.

A regular homeowner can only stomach a certain amount of loss, additionally, you cannot sell the house for less than you owe on the mortgage unless the mortgage holder is granted a short sale. If this was all their was to the market, prices would probably remain stagnant or fall just enough to be in the level where buyers can obtain financing.

Foreclosures and Bank owned properties change everything. Banks are not in the business of managing and maintaining properties. They will hold them for a certain time period hoping to get their money back, however, they do have the power to dump them for mark to market value and when the inventory builds, they will dump these houses at cut rate prices.

This in turn drives down comparable sales in the whole neighborhood and in turn, forces everyone to lose all their equity in their home just to compete with the REO properties for buyers interest.

House prices will continue to drop as long as foreclosures are occuring, and with the second wave of option arms resetting in the next 1-3 years it's going to get much worse than anyone can even imagine.

Posted by

Chris

at

7:42 PM

2

comments

![]()

Thursday, January 24, 2008

Free Money!

Details

Details

Enjoy your free money friends. If we are going to go bankrupt, we mine as well have one last big party, with someone else's money of course, before we face reality.

... thats the American way.

Oh... vewy crevah! Thank you president Brush for stimrurus package. Borrow more money from China! I rove America!

Posted by

Chris

at

11:46 AM

3

comments

![]()

Now there are five

With Ron Paul finishing second in Nevada, and a possible first in Louisiana once the provisional ballots are counted are you feeling a renewed sense of hope in the campaign?

Ron Paul is the only one out there with answers for the economy, and with his increased air time you would think the media is beginning to come around.

I know I am just dreaming, but with Rush Limbaugh saying he may not vote for any of the front runners, you have to think the door is open for Ron Paul to rise for super Tuesday if he has a good debate next week.

Posted by

Chris

at

11:35 AM

1 comments

![]()

Tuesday, January 22, 2008

Fed Panics

So Bernanke Panics and drama cuts the rate today.

The main problem I have with this move is not so much the rate cut itself; the problem lies within the intention behind it. Bernanke is trying to delay or stop the impending recession, and that is simply the worst thing he can possibly do.

Why doesn’t anyone understand that we actually need a recession? A recession is healthy for the economy. Boom and bust is capitalisms summer and winter and right now we need a nice cold winter to rest and regenerate after a brutally hot summer.

We need to decrease our spending, save money, and put an end to the mal-investment that was rampant for the past decade. A recession is very welcome at this point, and the longer we attempt to delay the recession the worse it will be when it inevitably comes. And trust me it is coming...no matter how many stimulus packages, rate cuts, or free money the government throws at us, its time to stop spending and pay the bills. The only thing we have control of is how bad and how long it’s going to be. Bernanke is only making it worse with his actions.

A 0.75 point rate cut is just going to make the clueless sheeple go deeper in debt spending on their heloc's and adjustable rate credit cards, its going to cause more people to trade on margin shorting stocks, and all the other borderline retarded things that occur which are driven with this kind of irresponsible fiscal loose money policy.

Americans need to realize that they are fighting a losing battle against a government that is not looking out for their own best interest. This has all been predicted and it hath been foretold. Hell, I am a college kid majoring in Biology and even I saw this coming, how can the ad wizards in Washington DC and Wall Street with advanced doctorate degrees in economics from Harvard not understand what’s really going on here?

I think the truth is they do know, but they just don't care because they know most Americans are to busy watching American Idol or are to stupid to even understand how corrupt and incompetent they really are.

I have a dream that someday Americans will awake from their apathy and stupidity and take their country back.

"We have it in our power to begin the world over again."

-- Thomas Paine

Posted by

Chris

at

10:29 PM

2

comments

![]()

Sunday, January 20, 2008

With China Revaluing its currency, Is this the beginning of the End of American Consumption?

Quick History Lesson.

China is brutal, cruel and has no consideration for the welfare and rights of its own people.

For years now China has been keeping its currency artificially low even as its economy has boomed, and it's factories produced billions of dollars of cheap goods.

Why would China do this you ask?

Simple...China did not want it's own people to buy the very products they were making in the factories. They wanted to keep the value of their currency artificially low, and pay the factory workers pennies on the dollar. The Chinese people would not be able to buy the products, which allowed them to ship their crap out to Wal-Mart stores across America so US citizens could enjoy a great bargain.

As they say on the infomercials that wake you up at 4 AM... Wait... There's more!

American consumer spending was fueled primarily by debt spending. Home equity loans on houses, massive credit card debt were all the rage for the past decade and someone had to buy that debt. Guess who? It was China who would buy the American debt allowing American consumption to continue, fueling China's manufacturing economy, fueling America's consumer spending economy, buying American debt, which would keep the Yuan artificially low vs the American dollar so that Americans could continue to afford cheap Chinese products.

The sick cycle carousel continued until 2005 when China began to revalue its currency, and as the American dollar continues to collapse the whole situation is about to spin into economic disaster.

This article I found, which I posted below, really tells the whole story, Wake up America...

The stock market is about to crash.

The Fed is destroying the dollar.

Inflation is causing people to go hungry.

And Economic disaster is looming on the horizon.

It hath been fortold.

Posted by

Chris

at

9:50 AM

1 comments

![]()

Chinese feel pain as Beijing revalues currency

SHANGHAI (AFP) - As China gradually relaxes its controls on its currency, few stand to lose as much as Wu Xiao, a Shanghai black market money changer who may soon be out of a job.

For more than a decade, the Chinese yuan was pegged artificially low against the dollar, resulting in the kind of spread between the official and the market-driven rate that underground traders thrive on. Life was good for Wu.

But since China revalued the yuan in 2005, leading to a cumulative appreciation against the dollar of about 14 percent so far, the spread has narrowed dramatically, and Wu's margins have plunged.

Wu is in a race against time to offload his pile of tightly packed greenbacks before they lose so much of their value that his profit vanishes. Even on the best of days, he makes only two yuan (27 cents) per 100 dollars.

"If the US dollar keeps depreciating then there's nothing we can do. The only way for us to make money is to buy and sell quickly. It's now always safer to have your money in yuan," said Wu.

The change in the exchange rate in January is equivalent to about a 16-percent hike on a yearly basis, and analysts have begun to forecast that yuan could gain as much as nine percent by the end of the year.

China's booming economy has long benefited from a currency that Beijing's trade partners blame for global commercial imbalances, as cheap Chinese exports have soared while more expensive imports have failed to keep pace.

Economic growth in China in 2007 is expected to come in at about 11.5 percent. Much of that expansion is directly related to Chinese exporters which, flush with cash, have ploughed the money back into assets at home.

As inflation has picked up pace -- hitting an alarming 11-year high in November -- regulators are beginning to worry that too much money in the financial system is a main factor behind economic overheating.

"Beijing is becoming ever more concerned about domestic inflation -- and the argument that an undervalued exchange rate is at the root of excess liquidity has won increasing numbers of converts," said Stephen Green, an economist at Standard Chartered in Shanghai.

"The idea has to be that the Chinese yuan appreciation will cool some of the upstream energy and raw material inflation pressure and cool export-related investment," said Green, who estimated the yuan will rise nine percent in 2008.

The good news for the Chinese consumer is that a stronger currency means greater purchasing power to buy imports. For China's globalising firms, it means they can buy overseas assets more cheaply.

But faster currency appreciation spells trouble for China-based exporters, which have to conduct the majority of their trade in dollars.

China Machine Building International Corp in southern Hunan province said the recent adjustments to the yuan had led to a loss of business.

"Some customers refuse to accept our price hikes," said manager Flora Hu.

For Shanghai-based Korean plastics chemical trader Hanren Trading, the change in the value of the yuan have forced it to consider shifting business from exports to imports.

"It cost us much more in production and delivery costs," said manager Yatta Mao, adding that the company faced a debilitating seven percent fall in profit margins.

Source

Posted by

Chris

at

9:09 AM

0

comments

![]()

Saturday, January 19, 2008

Ron Paul finishes Second in Nevada

Of course this is going to be ignored by the biased MSM. However, they can't change the fact that Ron Paul placed second in the face of a media blackout and smear campaign against him. The voters and campaign workers in Nevada should be applauded for their hard work.

Posted by

Chris

at

9:29 PM

2

comments

![]()

Friday, January 18, 2008

Breaking News: Growth package details

Chicken Little and the Flying Monkey were right after all!

Paulson: “After years of unsustainable price appreciation and lax lending practices, a housing correction is inevitable and necessary”.

Unconfirmed Details:

$800 dollars per individual

$1600 dollars per family

Reporter: "Can you be more specific"

Paulson: "We don't want to be specific"

Translation: "I am a moron, who is paid to spin and lie"

Posted by

Chris

at

9:14 AM

0

comments

![]()

Bush announces stimulus package for the economy

Will the package be a Stimpack?

Or a Super Stimpack?

-For all of you Fallout fans ;)

What is comical to me is that as the package was announced the stock market began to collapse even faster. I guess the traders on wall street did not think to highly of what was proposed.

If the feds send me a check in the mail I sure as hell will not be spending it, I will be using it to pay off the credit card debt I accumulated paying for the rising cost of food and gasoline while my wages remained virtually stagnant.

Hillary Clinton is a fraud, George Bush is a joke, Ben Bernanke is a criminal, and the house of cards that is the US economy is about to come tumbling down.

Posted by

Chris

at

9:04 AM

2

comments

![]()

Thursday, January 17, 2008

HEH-LARIOUS Michigan Romney Parody

Thanks to Housing Panic, The #1 Housing Crash Blog, for finding this video!

Posted by

Chris

at

9:03 PM

0

comments

![]()

Wednesday, January 16, 2008

Inflation Rate Worst in 17 years.

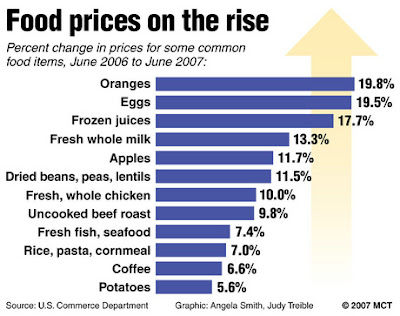

WASHINGTON - Higher costs for energy and food last year pushed inflation up by the largest amount in 17 years, even though prices generally remained tame outside of those two areas.

Consumer prices rose by 4.1 percent for all of 2007, up sharply from a 2.5 percent increase in 2006, with consumers especially feeling the pain when they filled up their gas tanks or shopped for groceries. Prices for both energy and food shot up by the largest amount since 1990.

Read Full Story Here

Posted by

Chris

at

6:12 AM

0

comments

![]()

Tuesday, January 15, 2008

10 Billion here, 10 Billion there, sooner or later it ads up to real money.

AP

Citi Loses Almost $10B, Slashes Dividend

Tuesday January 15, 9:11 am ET

By Madlen Read, AP Business Writer

NEW YORK (AP) -- Citigroup Inc. lost almost $10 billion in last year's final three months, the largest quarterly deficit in the bank's 196-year history, and slashed its dividend as it recorded a mammoth write-down for bad bets on the mortgage industry.

The nation's largest bank wrote down the value of its portfolio by $18.1 billion. It also boosted loan-loss reserves by $4.1 billion, signaling further problems in its consumer businesses as deflated home prices, high energy and food costs, and rising unemployment weigh on people's ability to make their loan payments...

... Americans will continue to watch American Idol completely oblivious to the fact that the economy is headed towards a 1929 style crash and depression. Wake up America, this is a frigging disaster and it's starting to get downright scary!

Posted by

Chris

at

6:33 AM

3

comments

![]()

Everybody Needs a Hero, heres mine...

"Let it not be said that no one cared, that no one objected once it's realized that our liberties and wealth are in jeopardy"

-Congressman Ron Paul M.D.

Tomorrow I will be casting my vote for Ron Paul in the Michigan Primary. Through campaigning, spreading the word to friends and family, I am confident that 10 votes for Ron Paul will be cast that would not have been had I done nothing.

When all is said and done, I do not believe that he will win Michigan, however, this will be the first vote I have ever cast in my life that will make me feel good about myself. I am voting for a man of honor, integrity, and I will be able to look myself in the mirror knowing I did everything I could to make a difference.

This election I will not cast a vote for the lesser of two evils, I will be casting a vote for the greater good, and I am proud as hell of everyone else who does the same.

Posted by

Chris

at

2:23 AM

6

comments

![]()

Monday, January 14, 2008

Miami Condo Market... Rent to Own?

Real Estate

Condo strategy: Rent now, buy later

The sprawling Midtown Miami condo development north of downtown is trying a new strategy to sell units in a stagnant market — rent to own.

Posted by

Chris

at

8:05 AM

0

comments

![]()

Saturday, January 12, 2008

Michigan Primary Voters, This is your last chance to make a difference.

Oh fiancé I can't, I can't get through

I've been trying hard to reach you, cause I don't know what to do

Oh fiancé I can't believe it's true

I'm so scared about the future and I wanna talk to you

Oh I wanna talk to you

You can take a picture of something you see

In the future where will I be?

You can climb a ladder up to the sun

Or write a song nobody has sung

Or do something that's never been done

...Vote for an honest man.

Posted by

Chris

at

8:43 PM

1 comments

![]()

Change yourself and change the world

There was a man who wanted to change the world. He found that he wasn't making much progress, so he tried instead to change his country. This was also too difficult, so he tried to change his neighborhood. When he didn't have success there, he tried to change his family. Even that was easier said than done, so he settled merely on changing himself.

And he succeeded!

Then an interesting thing happened. Once he had changed himself, he had an effect on his family, and his family changed as well. And as his family changed, they had an effect on their neighborhood, and that changed as well. When his neighborhood changed, the country changed, too! And when his country changed, the world changed!

One man can change the world.

Posted by

Chris

at

8:40 PM

1 comments

![]()

Friday, January 11, 2008

HousingFEAR thought of the Day.

High gas and food.

Same wages.

Dried up easy money lending.

No savings.

Shrinking equity.

Political unrest.

Communist threat.

Stagnate stock market.

Skyrocketing inflation.

High unemployment.

Biased media.

Biased government.

Biased Federal Reserve Board.

And the genuine ability for people to make their own decisions based on open forums like this one instead of just watching the news.

-Courtesy of Devestment

Posted by

Chris

at

11:39 AM

0

comments

![]()

Manhattan Real Estate Prices in Dollars vs Gold

Confused?

Don't worry I was also at first glance.

Basically what the chart shows is that although house prices in Manhattan NYC are appreciating in terms of US Dollars since 2000, they are actually losing value when measured against gold.

What does that mean? It means that the dollar is becoming worthless and real estate is losing true value in terms of wealth at the very same time.

We have reached a situation where we have an inflated currency but deflating home prices.

Stagflation has arrived.

Posted by

Chris

at

12:01 AM

0

comments

![]()

Thursday, January 10, 2008

This ad brings tears to my eyes

I am realizing now with the reports of vote fraud in NH that the people in power will not let the votes be counted fairly, and they will not let Ron Paul win.

I heard a quote once that said, "freedom is never obtained through peace, it is only obtained through violence". If you look at the revolutionary war in America, the French Revolution, etc it seems that may be true, and I think that is very sad.

I really hope more people wake up to the fact that we are no longer the land of the free.

Posted by

Chris

at

8:37 AM

0

comments

![]()

Realtors quitting their day jobs and going back to waiting tables

As Housing Slumps, Realtors Quit.

As many train for new careers, return to old ones, or wait tables until prices rebound, the plight of the real estate agent – average age, 51 – reveals the human dimension of how loose lending, raw opportunity, and self-determination produced a housing bust that has stunned the US economy.

Full Story Here

...Hey atleast they are making an honest living this time! ;)

Posted by

Chris

at

12:03 AM

1 comments

![]()

Wednesday, January 9, 2008

I never really believed in the bible, I am starting to now...

"After this I looked, and, behold, a door was open in heaven: and the first voice which I heard was as if it were a trumpet talking with me; which said, Come up here, and I will show you things which must be hereafter" (Revelation 4:1)

Posted by

Chris

at

1:34 PM

2

comments

![]()

Gold to da Moon Alice!

Oh yes baby, that is the color of real money.

I will now make the prediction here and now that Gold is going to $1000 dollars an ounce.

I see Gold as really the panic meter of the US economy, low gold prices means the economy is doing well and gold is just a pretty yellow metal used in jewelry. When the economy is doing bad and people are afraid of inflation and economic disaster, Gold becomes really currency, it becomes real wealth and it skyrockets in price.

Guess whats coming.

Posted by

Chris

at

7:23 AM

3

comments

![]()

Top 5 Most Ridiculous Mortgage Borrower Stories of 2007

There are people who are losing their home to foreclosure because of a legitimate financial crisis, but there are even more people who are losing their home because of lender follies and their own greed and stupidity. Here are five stories in particular that are sure to induce a fit of eye rolling.

1. Casey Serin

Casey Serin--the self-dubbed 'World's Most Hated Blogger'--purchased eight homes between October 2005 and May 2006 intending to fix them up and sell them. The unemployed Serin lied on all of his mortgage applications to get the loans and receive cash back at closing. At one point, the 24 year old would-be real estate mogul was more than $2.2 million in debt.

Not surprisingly, Serin lost all of his homes to foreclosure in 2007. The news coverage was significant. The earliest media stories suggested Serin was a victim of greedy mortgage lenders, but reporters eventually picked up on the fact that the guy lied on his mortgage applications and coverage turned negative.

2. The Strawberry Picker

How does a California strawberry picker earning less than $15,000 a year get a home loan for $720,000? That was the question everyone wanted an answer to last year. Borrower Alberto Ramirez, an immigrant who did not speak English, blamed his real estate agent.

Apparently, the agent was so eager for commission that she arranged for the loan through New Century Mortgage and paid what the Ramirez family couldn't for several months. This arrangement was supposed to carry the borrower until he could refinance.

But of course, it wasn't the loan that was the problem--the house was simply unaffordable given the borrower's income. Within a few months, the agent quit subsidizing the Ramirez's payments and the borrower quit paying on the advice of an attorney.

3. The Boyle Heights Victim

A number of sites linked the story of Cynthia Szukala, which first ran in the New Angeles Monthly. The story painted the newly widowed Szukala as the ultimate victim of unscrupulous mortgage brokers.

Szukala claimed a broker took advantage of her and her husband in 2006 when they made the decision to refinance by putting them in an interest only loan. The writer of the story mentioned Szukala's tear-filled eyes and the fact that the widow had no idea how she would make the mortgage payments when the loan reset.

After several blogs linked to the story, a studious reader decided to do the legwork the reporter should have done. The reader found that the Szukalas knew much more about the mortgage business than Cynthia had let on.

In nine years time, the couple had refinanced their loan not once or twice as Cynthia indicated, but seven times. They had been living off equity for years, borrowing nearly $300,000 in all (about $31,300 per year).

4. The Fullerton Grandparents

The story of a Fullerton area elderly couple who couldn't afford their mortgage payments sparked a huge online debate when it first appeared in the Orange County Register.

Some readers sympathized with the Coffmans who were unemployed, 60 years of age and caring for six adopted grandchildren. Others were so outraged at the paper's 'bogus heart tugging drivel' that they demanded the story be pulled.

The debate centered on the fact that the Coffmans extracted more than $600,000 from the $97,000 home they bought in 1977. The bulk of the money--$552,300--came from Countrywide in 2005. The rest was obtained later from several other lenders, including Washington Mutual, Wells Fargo and Greenpoint Mortgage Funding.

The Coffmans can no longer afford their mortgage payments on the $5,400 a month income they get from Social Security and government assistance. There is also no money left for a refinance.

Countrywide claims they are not to blame as the Coffmans had a firm understanding of the negatively amortizing loan they chose. To the Coffman's credit, they admit that they made 'some really bad decisions.

5. The Hahn Family

Jeffrey and Vanessa Hahn bought a $475,000 house in 2004 using an adjustable rate mortgage and took out a significant home equity loan not long afterwards. In September of 2006, the interest rate on the main mortgage reset, causing the payment on their main mortgage to increase from $2,200 per month to $3,700 per month.

In March of 2007, the couple got a cash-out refinance to the tune of $570,000 even though the required monthly payments equaled their monthly take-home pay. Needless to say, they never made a payment on the loan and lost their home to foreclosure.

When the San Francisco Chronicle profiled the Hahns, Jeffrey said he was 'shocked' by the number of hate comments that were generated.

'I just don't get how these people can judge me like this and think we completely took advantage of the system. The system took advantage of us,' Hahn was quoted as saying.

Source: Homeguide123.com

Posted by

Chris

at

6:56 AM

1 comments

![]()

America is Bleeding from Foreclosure Crisis

The map represents foreclosures by county in the US. It is pretty disturbing because it almost looks like the country is bleeding, I guess in a way it really is. I think the saddest thing is about the whole crisis is I don't believe anyone has really learned anything from this at all.

Posted by

Chris

at

6:33 AM

0

comments

![]()

Tuesday, January 8, 2008

NH Primary Today

I had my hopes up in Iowa, and I have to say I was very disappointed to see Ron Paul come in 5th. Although Paul pulled in 10% of the vote and did decent in Iowa... NH is perhaps his last, best chance to really pull off an upset and get some name recognition.

If I had to place money on it I would say its looking like...

1) McCain

2) Romney

3) Paul

I can only dream that Paul somehow pulls off a major upset, but even a third place finish would raise some eyebrows and would be very welcome right now.

Posted by

Chris

at

12:50 AM

0

comments

![]()

Monday, January 7, 2008

Bankruptcies jump 40 percent in 2007

The American Bankruptcy Institute blames the mortgage crisis for heavy debt load, warns that this year could see more bankruptcies.

NEW YORK (CNNMoney.com) -- The number of Americans filing for consumer bankruptcy increased by nearly 40 percent in 2007, according to the American Bankruptcy Institute.In a report released Thursday, the ABI said that the number of overall consumer bankruptcy filings reached 801,840 last year, compared to 573,203 in 2006.

"The roughly 40 percent spike in consumer bankruptcies during 2007 presages [an] even higher [number of] filings this year, as the heavy consumer debt load is made worse by the home mortgage crisis," predicted ABI Executive Director Samuel J. Gerdano.

However, the report also showed that the number of bankruptcy filings declined 7.5 percent in December from November. And Chapter 13 filings - those available to individuals with regular income whose debts do not exceed specific amounts - also showed a decline from November to December.

I predict that by 2010 having a bankruptcy or foreclosure on your credit report will be like having a divorce.... So common that creditors will not even flinch when they see it.

I am already seeing ads for apartments in my area that say " We're Foreclosure Friendly". My guess is you will be seeing a lot more of those coming to a complex near you also.

Posted by

Chris

at

11:42 PM

2

comments

![]()

Saturday, January 5, 2008

Soybeans @ 34 year price high

Jan. 4 (Bloomberg) -- Platinum advanced to a record, soybeans climbed to a 34-year peak, and crude oil and gold traded near their highest ever, as a declining dollar increased the allure of commodities as a hedge against inflation.

The UBS Bloomberg Constant Maturity Commodity Index rose as much as 1.7 percent to a record 1,327.21 yesterday as oil jumped to $100.09 a barrel and gold for immediate delivery reached $868.89 an ounce. Copper extended its advance in London today, heading for its biggest two-day gain in almost nine months.

But....but.....The government says inflation is only at 2.8%!?!

Posted by

Chris

at

5:33 AM

0

comments

![]()

Friday, January 4, 2008

Oil prices strike new 100-dollar record

Peter Schiff predicted this would happen back in 2006 in his book Crash Proof; How to Profit from the Coming Economic Collapse. Once again he is right on the money!

Economic Armageddon is brewing on the horizon and people are fleeing to safe havens of Gold to preserve their wealth, Gold is now at a staggering 867.90 dollars an ounce. With inflation roaring, and the weak US Dollar oil is now over $100 dollars a barrel.

Get ready folks, 2008 is going to be a rough one.

Source:

LONDON (AFP) — Oil prices leapt back into triple figures on Thursday, striking a record high of 100.05 dollars in New York on worries about tight supplies and US currency weakness.

The double effect of surging oil prices and the weakening US dollar pushed gold to its own record. The precious metal struck an historic peak of 867.90 dollars an ounce.

Gold is seen as a defence against inflation, driven in many countries by the surging cost of crude oil.

"Investors are worried about the oil prices and the weak dollar," said Gary Yue, a dealer at Delta Asia Financial Group.

"When the situation is unstable, they invest their money elsewhere and this has boosted the buying interest in gold."

Posted by

Chris

at

7:07 AM

0

comments

![]()

Peak Oil

It amazes me how many people do not see the disaster we are heading towards. With oil now at record highs it is only a matter of time before the economy collapses. How do working class Americans take vacations, buy electronics, and fuel our consumer economy when all of their disposable income is headed for gasoline?

Minimum wage is around $7.00 an hour in most states and we are headed for $3.50-$4.00 a gallon of gasoline.

The effects this will have on the economy will be mind blowing.

Posted by

Chris

at

7:02 AM

0

comments

![]()

Tom Iancno's predictions for 2008

1. Lots More Pain for Housing

There is a near consensus that housing is in for more trouble in 2008, but this is not one of those cases where it would be better to go against the crowd - that will happen in another couple years or so when your friends and neighbors tell you that real estate is a horrible investment. Just like back in 1995-1996, when no one wanted to go near an open house five years after that last peak - that's when you'll know we've hit bottom.

Housing prices will fall another 10 percent nationally, based on the year-over-year change to the 20-city S&P Case Shiller Home Price Index for October 2008 (this report gets released at the end of December and showed a 6.7 percent decline as of last week.)

In some areas home prices will reach 2003 levels, which, in California, would still be more than double the price at the 1995-1996 bottom but will be a painful 40 percent below the 2006 peak. Don't let talk of stabilizing sales for new or existing homes confuse the issue of home prices - home prices will continue to fall as long as inventory remains at historically high levels.

2. The Dollar Will Continue to Go Down

The eight percent decline in 2007 on the trade weighted U.S. dollar index (against the Euro, Yen, Pound, etc.) was such a success that there will be another, slightly smaller, decline in 2008. By year-end the index will be at 71 or 72 and economists will marvel at how the trade deficit is narrowing and how gross domestic product is receiving welcomed support due to more exports.

The Japanese yen will gain the most against the greenback and both the euro and the Canadian loonie will strengthen, but not as much as in 2007. The British pound will lose ground to the buck as credit and housing market problems accelerate in the U.K.

3. It Will Be a Bad Year for U.S. Equities

The Dow and the S&P 500 Index will decline by 5 percent and the Nasdaq will gain 1 percent. Foreign stocks will continue to do better than U.S. stocks, but there will be fewer high-flyers than in 2007.

The Chinese stock market will gain more than 50 percent by summer and then lose most of the gains by year-end. The Japanese stock market will be one of the top performers in the world.

4. Short-Term Interest Rates Will Go Much Lower

The Fed will cut interest rates by a quarter-point at every meeting and at one meeting they will cut by a half-point putting the Fed Funds rates at an even two percent by year-end.

They'll continue to talk tough about inflation occasionally but no one will really care - inflation will be the least of the country's problems by summer.

5. Energy Prices Will Continue to Rise

The price of crude oil will rise to over $130 per barrel before ending the year at $115 per barrel. Just like $3 gasoline wasn't a big deal, $4 gasoline won't be a big deal either - unless of course you use your car a lot and/or you don't make a lot of money. Then it will be a big deal.

Natural gas, a laggard over the last two years after a spectacular rise in 2005, will surprise to the upside in 2008.

6. Gold and Silver Will Continue to Rise

Gold will spike to over $1,000 per ounce and finish the year just below that mark. Silver will hit $22 per ounce and end the year at $19. There will be at least two gut-wrenching corrections that will cause many new investors to make an early exit from precious metals markets, but they'll be back.

People will start talking about junior mining stocks at cocktail parties - just like internet stocks in 1997. (I'm going to keep saying this until it's true).

7. Economic Growth will Turn Negative, Consumption will Decline

This is the year that the American consumer finally pulls back in a big way and real economic growth will be negative in two quarters. Home equity, the source for much of consumer spending in recent years, will vanish more quickly due to falling home prices than it did when people were spending their home equity like drunken sailors.

8. Reported Inflation will Remain Contained

More people will realize that the government's inflation numbers are bogus. They won't be happy about it.

9. Job Growth Will Turn Negative by Year-End

State and local governments will cut back on hiring due to shrinking tax revenue and fewer people will eat out - two important props for the job market will be partially removed. Employment in health care will continue to boom and even fewer people will talk about the looming Medicare crisis.

By the end of 2008, year-over-year job growth will turn negative but it will be impossible to really know for sure until sometime in 2010 when the Bureau of Labor Statistics completes all its revisions for 2008.

Help wanted signs at coffee shops and restaurants will slowly disappear which will be unfortunate for those teenagers who finally have to start looking for low-paying jobs to buy their next iPod or cell phone because their parents have spent all their home equity.

10. Hillary or Barack will Win the Election

It's too bad Ron Paul isn't ten or fifteen years younger - in another eight years the country will be ready for him.

![]()

© 2008 Tim Iacono

Editorial Archive

CONTACT INFORMATION

Tim Iacono

Iacono Research, LLC

Southern California

Email | Website | Blog

Posted by

Chris

at

6:56 AM

0

comments

![]()

Wednesday, January 2, 2008

Tomorrow

"First they ignore you...

Then they ridicule you...

Then they fight you...

Then you win!"

-- Mahatma Gandhi

Posted by

Chris

at

10:32 PM

1 comments

![]()

January 31st, 2008 at 8:50 am

I would say that those who’ve realized we’re headed for the Mother Of All Great Depressions, and they can be miserable about it, or make the best of it like Jack London, Euell Gibbons, Harry Partch, and other luminaries who embraced the hobo life and used their experiences to inspire their art. George Orwell too, he washed dishes in the 1930s, when he was lucky. Henry Miller is another - I personally feel his books were banned not for the liberal use of (Profanity) but because they pointed out how bogus the American Nightmare is.