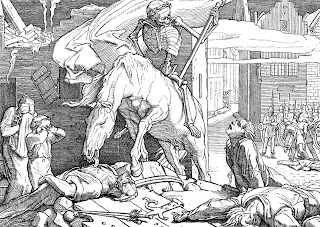

I saw a pale horse and upon it a pale rider.

The name of the horse was Pestilence.

The name of the rider was Death..

Friday, February 22, 2008

The 12 steps to Financial Armageddon.

Posted by

Chris

at

9:00 PM

![]()

5 comments:

-

Anonymous said...

-

read

www.leap2020.eu

> They say more or less the same. -

March 3, 2008 at 2:05 AM

- Russ DoGG said...

-

this blog sucks, not because of hte content but these obnoxious java scriptlets that keep my computer so busy that I can't even scroll to read.

It behaves perfectly normally when I disable javascript.

can you cut that shit out already? -

March 9, 2008 at 10:57 PM

- Unknown said...

-

Um maybe you should quote your sources. The 12 steps to armageddon was originally written by Nouriel Roubini a professor of economics at NYU.

-

March 19, 2008 at 8:23 PM

- Chris said...

-

I did,

Permarenter on Patrick.net posted this as if it was his own writing and I gave him credit.

I did not know that he had taken it from Nouriel Roubini. -

March 24, 2008 at 10:44 AM

-

Anonymous said...

-

Lots of dung flying downtown Tampa today smell bad for the banks. I went to the Tampa REDC foreclosure sale at the Tampa convention center. It was a joke. In my opinion, these are just markerting plows to move dead inventory not sell homes. In my opinion, these banks are not ready to sell. They want to try and trick people and con people into paying high values or full market price. What happened today proves it. The I want to educate people on was a for sale 4/5/08 and the house which was number 3 on the auction list 5157 Loquat Ct Palm Harbour , FL 34685. Look at the market comps yourself first. Well first they skipped it and auctioned it off as number #5 in the auction order. It was a cash sale. It went up on the auction block and got auctioned for 390k. About 50k higher than market value. A third of the audience beleived it was shill betting and walked out of the auction. Yes a mass exodus. The auctioned begged the people to stay as they were leaving saying it may be auctioned off again later. Well an hour and a half later it was back up for auction like many of the homes. In my opinion, lots of shill bids. If auctionaire doesnt get the price he wants in the shrill bid process it goes up again later the sam day. Scam cheating and lies still beware. Sencond time on auction block 350k. Ya right. I believe that everyone in the same neiborhood can sell similar homes for 350k but magically this ones sells. Make your own judgement.

-

April 5, 2008 at 2:04 PM

February 22nd, 2008 at 8:35 pm

Step 1 is the worst housing recession in US history. House prices will, he says, fall by 20 to 30 per cent from their peak, which would wipe out between $4,000bn and $6,000bn in household wealth. Ten million households will end up with negative equity and so with a huge incentive to put the house keys in the post and depart for greener fields. Many more home-builders will be bankrupted.

Step 2 would be further losses, beyond the $250bn-$300bn now estimated, for subprime mortgages. About 60 per cent of all mortgage origination between 2005 and 2007 had “reckless or toxic features”, argues Prof Roubini. Goldman Sachs estimates mortgage losses at $400bn. But if home prices fell by more than 20 per cent, losses would be bigger. That would further impair the banks’ ability to offer credit.

Step 3 would be big losses on unsecured consumer debt: credit cards, auto loans, student loans and so forth. The “credit crunch” would then spread from mortgages to a wide range of consumer credit.

Step 4 would be the downgrading of the monoline insurers, which do not deserve the AAA rating on which their business depends. A further $150bn writedown of asset-backed securities would then ensue.

Step 5 would be the meltdown of the commercial property market, while step six would be bankruptcy of a large regional or national bank.

Step 7 would be big losses on reckless leveraged buy-outs. Hundreds of billions of dollars of such loans are now stuck on the balance sheets of financial institutions.

Step 8 would be a wave of corporate defaults. On average, US companies are in decent shape, but a “fat tail” of companies has low profitability and heavy debt. Such defaults would spread losses in “credit default swaps”, which insure such debt. The losses could be $250bn. Some insurers might go bankrupt.

Step 9 would be a meltdown in the “shadow financial system”. Dealing with the distress of hedge funds, special investment vehicles and so forth will be made more difficult by the fact that they have no direct access to lending from central banks.

Step 10 would be a further collapse in stock prices. Failures of hedge funds, margin calls and shorting could lead to cascading falls in prices.

Step 11 would be a drying-up of liquidity in a range of financial markets, including interbank and money markets. Behind this would be a jump in concerns about solvency.

Step 12 would be “a vicious circle of losses, capital reduction, credit contraction, forced liquidation and fire sales of assets at below fundamental prices”.