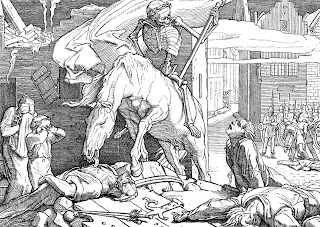

I saw a pale horse and upon it a pale rider.

The name of the horse was Pestilence.

The name of the rider was Death..

Across the dark sky flashed scenes from his unethical life.

For each scene, he noticed

two sets of footprints in the sand,

one beloning to him and the other to Bernanke.

When the last scene of his useless life flashed before him,

he looked back at the footprints in the sand.

He noticed that many times along the path of his life

there was only one set of footprints.

He also noticed that it happened at the

very lowest and saddest point of the mortgage crisis.

This bothered him and he questioned Bernanke about it.

"Bernanke, you said that once I decided to follow you,

you'd walk with me all the way.

But I have noticed that during the most

troublesome times in the housing crisis there is

only one set of footprints.

I don't understand why when I needed you most

you would leave me."

Bernanke replied "My precious, precious child,

I love you and would never leave you.

During your times of trial and suffereing,

when you see only one set of footprints in the sand,

it was then that I froze subprime arms."

Some 4.9 percent of the households in the Detroit metro area were in some stage of foreclosure in 2007 — 4.8 times the national average, according to the study being released Wednesday by mortgage research company RealtyTrac Inc.

Stockton, Calif., ranked second with about 4.8 percent of its households in some stage of foreclosure, while the Las Vegas metro area was third with a 4.2 percent rate.

Irvine, Calif.-based RealtyTrac determines the ranking by comparing the number of households in a metro area with the number of foreclosure filings, which include notices of default, auction sale notices or bank repossessions.

In all, 72,616 filings on 41,273 properties were reported in the Detroit metro area, which includes Livonia and Dearborn. The foreclosure rate represents a 68 percent jump from 2006, RealtyTrac said.

Michigan has been in a protracted economic downturn and has led the nation in unemployment, a combination that has caused many homeowners to fall behind on mortgage payments.

Another Michigan metro area comprising Warren, Farmington Hills and Troy was ranked 17th, with 2.1 percent of its households facing foreclosure.

This shortsighted plan poses a terrible risk to every American taxpayer, especially retirees, because Social Security money will be needed to bail out Fannie and Freddie. And even if you live in high-priced San Francisco, Los Angeles or New York - and stand to benefit from the increased loan limit - this is a horrible fraud on you, too, because raising the limit to $730,000 risks a systemic crisis that will cost far more than any temporary rebate check.

In support of the economic stimulus bill, Bush will have to face "working American families" and explain that some of their tax money is going to be spent guaranteeing $730,000 mortgages on $1 million homes. It's like some sort of upside-down communism where the poor pay the rich welfare. Why should taxes from families earning $48,000 a year be used to support expensive mortgages in New York, Los Angeles and San Francisco? Welfare for the hungry and homeless is evil, but welfare for million-dollar homeowners facing a tough refi ... well, that's called "helping the economy."

I can imagine the president's radio address playing in the heartland: "We have some families with million-dollar homes on the coasts who are really hurting and so we need you, the working families of America, to stand together with them and help them avoid the kind of home price depreciation that might leave them without a new Lexus for years."

-Sean Olender

As much as I am disappointed and saddened by last night, this message written by Doug Wead on his blog really puts the whole election into context. Ron Paul will not win the nomination, however, the revolution and idea's that his candidacy have ignited will not be extinguished.

Well now, Republicans say, we have a nominee. That may very well be but there was only one clear winner in the confusing GOP nominating contest and it was not John McCain. The winner was Ron Paul. And the effects of his win will be felt for years to come.

Ron Paul made a classic political mistake. He told the truth. In debate after debate he pointed at his party, his president, his fellow contenders for the GOP nomination, shouting aloud like the little boy in the proverbial story, “they have no clothes” and lo and behold, we looked and they didn’t. They were all naked.

He showed that the conservative movement has lost its way, its moral authority and its logic. He showed us that we have become a red team versus blue team. That since we have decided that this is a political war and all normal rules are suspended, conservatives can do liberal things to win it. Conservatives can run up big deficits if it helps their side win. They can dole out needless pork if it elects another “conservative” to congress. They can go to war if it makes their president look like a leader and wins him another term.

But in the process, Ron Paul showed us, that we have lost our way. We are no longer conservatives. We are fighting for power not for principles. We have become corrupted by the process and the only way back is to retrace our steps and find all the things we discarded along he way.

Barry Goldwater lighted a similar fire with his Conscience of a Conservative. Its truth and arguments were so obvious and so honest that one laughed aloud while reading it. But Goldwater, himself, was doomed to political defeat. And Ron Paul had no chance to win this election either. One could see that when he first opened his mouth.

And yet, the words and arguments of Ron Paul are still resonating. They still hang over this election. They are haunting and troubling. They are producing blogs and papers and books and like Goldwater’s revolution they will one day very likely produce their own Ronald Reagan. And when those heady days happen a small but hearty band of pioneers, who first had the nerve to join him and start shouting from the street, “They aren’t wearing any clothes,” will be able to say that they could see what the country missed. They were there when history was made.

John McCain and his poorly chosen words, of staying in Iraq a hundred years, have almost guaranteed that he will be the answer to the trivia question, who was the Republican candidate who lost to the ticket that claimed the first woman and black for the presidency? Another question may very well be, “What other candidate ran that year and launched the movement that has dominated national politics for the last generation?”

And the answer will be Ron Paul.

ONTARIO, California (Reuters) - Between railroad tracks and beneath the roar of departing planes sits "tent city," a terminus for homeless people. It is not, as might be expected, in a blighted city center, but in the once-booming suburbia of Southern California.

The noisy, dusty camp sprang up in July with 20 residents and now numbers 200 people, including several children, growing as this region east of Los Angeles has been hit by the U.S. housing crisis.

The unraveling of the region known as the Inland Empire reads like a 21st century version of "The Grapes of Wrath," John Steinbeck's novel about families driven from their lands by the Great Depression.

As more families throw in the towel and head to foreclosure here and across the nation, the social costs of collapse are adding up in the form of higher rates of homelessness, crime and even disease.

While no current residents claim to be victims of foreclosure, all agree that tent city is a symptom of the wider economic downturn. And it's just a matter of time before foreclosed families end up at tent city, local housing experts say.

"They don't hit the streets immediately," said activist Jane Mercer. Most families can find transitional housing in a motel or with friends before turning to charity or the streets. "They only hit tent city when they really bottom out."

Steve, 50, who declined to give his last name, moved to tent city four months ago. He gets social security payments, but cannot work and said rents are too high.

"House prices are going down, but the rentals are sky-high," said Steve. "If it wasn't for here, I wouldn't have a place to go."

Is this really happening in America?

February 22nd, 2008 at 8:35 pm

Step 1 is the worst housing recession in US history. House prices will, he says, fall by 20 to 30 per cent from their peak, which would wipe out between $4,000bn and $6,000bn in household wealth. Ten million households will end up with negative equity and so with a huge incentive to put the house keys in the post and depart for greener fields. Many more home-builders will be bankrupted.

Step 2 would be further losses, beyond the $250bn-$300bn now estimated, for subprime mortgages. About 60 per cent of all mortgage origination between 2005 and 2007 had “reckless or toxic features”, argues Prof Roubini. Goldman Sachs estimates mortgage losses at $400bn. But if home prices fell by more than 20 per cent, losses would be bigger. That would further impair the banks’ ability to offer credit.

Step 3 would be big losses on unsecured consumer debt: credit cards, auto loans, student loans and so forth. The “credit crunch” would then spread from mortgages to a wide range of consumer credit.

Step 4 would be the downgrading of the monoline insurers, which do not deserve the AAA rating on which their business depends. A further $150bn writedown of asset-backed securities would then ensue.

Step 5 would be the meltdown of the commercial property market, while step six would be bankruptcy of a large regional or national bank.

Step 7 would be big losses on reckless leveraged buy-outs. Hundreds of billions of dollars of such loans are now stuck on the balance sheets of financial institutions.

Step 8 would be a wave of corporate defaults. On average, US companies are in decent shape, but a “fat tail” of companies has low profitability and heavy debt. Such defaults would spread losses in “credit default swaps”, which insure such debt. The losses could be $250bn. Some insurers might go bankrupt.

Step 9 would be a meltdown in the “shadow financial system”. Dealing with the distress of hedge funds, special investment vehicles and so forth will be made more difficult by the fact that they have no direct access to lending from central banks.

Step 10 would be a further collapse in stock prices. Failures of hedge funds, margin calls and shorting could lead to cascading falls in prices.

Step 11 would be a drying-up of liquidity in a range of financial markets, including interbank and money markets. Behind this would be a jump in concerns about solvency.

Step 12 would be “a vicious circle of losses, capital reduction, credit contraction, forced liquidation and fire sales of assets at below fundamental prices”.